Dubai has long stood as a global gateway for international trade, and businesses engaging in import or export activities must navigate essential regulatory requirements to operate smoothly. One such key requirement is obtaining a Customs Code—a unique registration number issued by Dubai Customs. But what is an Import and Export Custom Code in UAE, and why is it so crucial? The Import and Export Custom Clearance Code (also referred to as an Import-Export Code or IEC) is a mandatory identification number that allows companies to legally import and export goods in and out of the UAE. Without this code, your shipments could be delayed or rejected at the border. Whether you’re dealing in electronics, fashion, food, or raw materials, obtaining your Customs Code in Dubai UAE is a necessary step in ensuring compliance with local regulations and customs procedures.

Table of Contents

ToggleIf you’re wondering how to get your Dubai Customs Code, the process is straightforward yet essential. It involves registering your business on the Dubai Trade portal, uploading key documents such as your trade license, passport copies, and paying the applicable fee. This code is valid for one year and must be renewed annually.

With the UAE increasingly digitizing its trade processes, securing a UAE CUSTOM / IMPORT-EXPORT CODE (IEC) new registration has never been more accessible. If you’re planning to start an import and export business in Dubai, getting your customs code is one of the first steps towards legal, smooth, and efficient operations.

Read Post: How to Setup Business in UAE?

Benefits of Obtaining Dubai Import and Export Custom Code

If you’re planning to engage in global trade from the UAE, obtaining your customs code in Dubai UAE is not just a requirement—it’s a strategic asset. A Dubai customs code simplifies international transactions, enhances operational efficiency, and keeps your business legally compliant.

1. Legal Authorization for International Trade

The Import and Export Custom Code in UAE serves as legal authorization to move goods through UAE ports. Without it, businesses cannot complete customs clearance procedures, making it a mandatory step to avoid penalties or shipment delays.

2. Smooth Customs Clearance Process

Having a Custom Clearance Code ensures your shipments move through customs quickly and efficiently. It reduces paperwork, minimizes delays, and helps avoid miscommunication with Dubai Customs authorities.

3. Access to Free Zones and Port Facilities

A valid customs code is essential for businesses operating in UAE free zones. It allows seamless movement of goods between mainland and free zones and is a prerequisite for using bonded warehouses and customs exemptions.

4. Improved Import/Export Efficiency

Businesses with a Dubai Customs Code experience streamlined logistics, better tracking of shipments, and faster processing of imports and exports—giving them a competitive edge.

Read Post: Top 24 Successful Business Ideas in Dubai for 2024

5. Regulatory Compliance and Renewal Ease

The code is valid for one year and renewable annually. Staying compliant through annual renewal ensures uninterrupted trading activity. The cost of Import and Export Custom Code in UAE is minimal, usually AED 520 for new codes and AED 25 for renewals.

Summary Table: Key Benefits of Customs Code in Dubai

| Benefit | Description |

|---|---|

| Legal Trading Authorization | Required to import/export goods in the UAE |

| Faster Customs Clearance | Streamlines shipment approvals and documentation |

| Access to Free Zones | Essential for free zone operations and customs exemptions |

| Enhanced Operational Efficiency | Reduces delays and improves supply chain management |

| Regulatory Compliance | Ensures adherence to UAE laws and customs regulations |

| Low Registration and Renewal Cost | AED 520 for registration; AED 25 for annual renewal |

Obtaining a UAE CUSTOM / IMPORT-EXPORT CODE (IEC) new registration is one of the first and smartest steps to take when setting up an import and export business license in Dubai. It enables smooth cross-border trade while keeping your business fully compliant and ready for global success.

Read Post: Business Setup Costs in Dubai for 2024-25

Step-by-Step Guide to Obtain Your IMPORT-EXPORT CODE in Dubai

Whether you’re launching a trading business or planning to expand into international markets, obtaining your Customs Code in Dubai UAE is essential. Here’s a simplified guide to help you understand the process, documents required, and associated costs.

Step 1: Obtain a Valid Trade License

To begin, your company must hold a valid Import and Export business license in Dubai—either from the mainland or a free zone. The license must specify import/export activity as part of the approved operations.

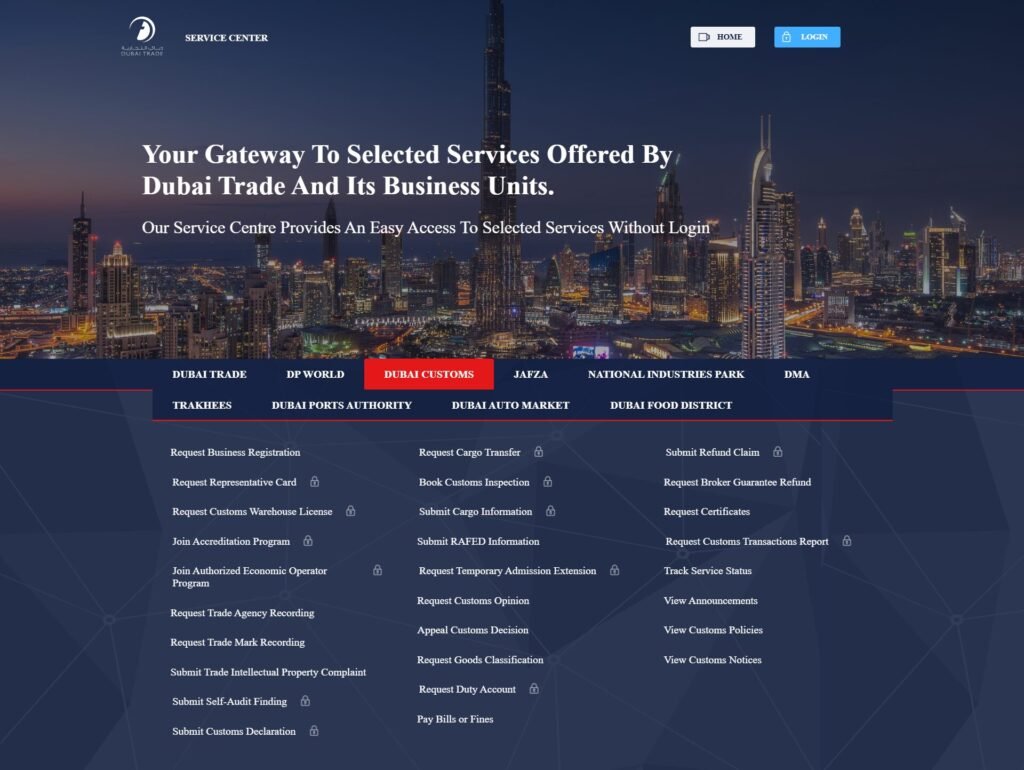

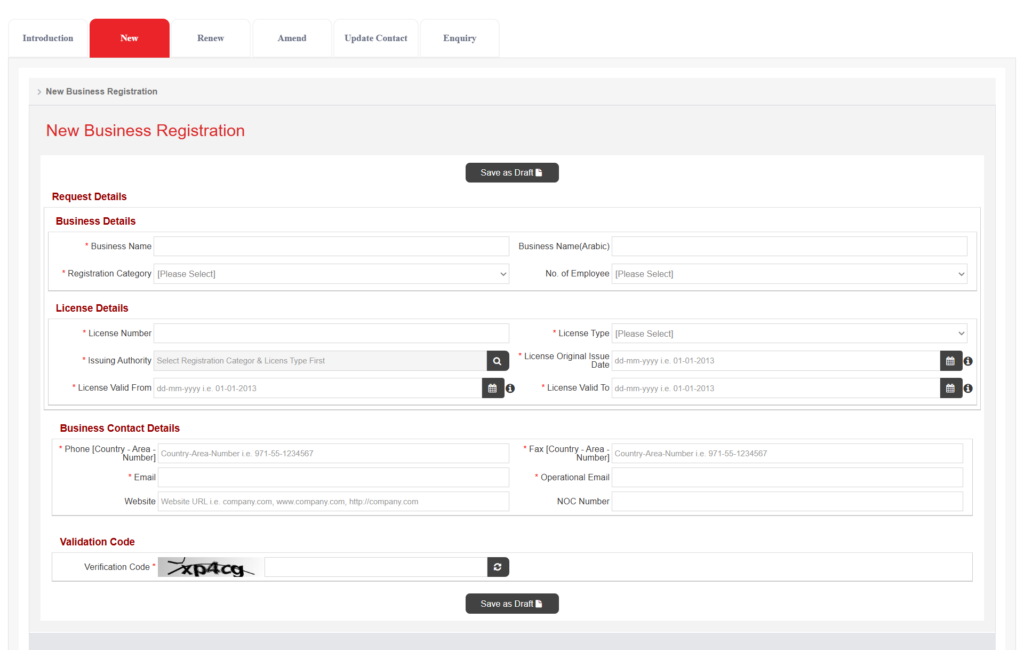

Step 2: Register on Dubai Trade Portal

Visit the official Dubai Trade Portal and create a new account using your business credentials. This online system links your company with Dubai Customs for all future trade activities.

Step 3: Upload Required Documents

You must upload the following:

- Valid Trade License

- Passport copy of business owner(s)

- Emirates ID copy (if applicable)

- Company stamp

- Request letter on company letterhead

These documents are critical for verifying the authenticity of your business and ensuring legal compliance.

Step 4: Pay the Required Fees

After uploading the documents, proceed to pay the registration fee through the portal. See the cost breakdown in the table below.

Step 5: Receive Your Import-Export Customs Code

Upon approval, you’ll receive your Dubai Customs Code—typically within 2–3 business days. This code must be used for all import/export transactions and renewed annually.

Read Post: How Much Does It Cost to Start a Restaurant Business in Dubai?

Pricing Table: Cost of Import and Export Custom Code in UAE

| Service Type | Service Description | Base Fee (AED) | Knowledge & Innovation Fee (AED) | Total Payable (AED) |

|---|---|---|---|---|

| New Registration | Initial registration for Import-Export Customs Code (Including Service Charges) | AED 500.00 | AED 20.00 | AED 520.00 |

| Renewal | Annual renewal of the Customs Code (matches trade license validity) | AED 25.00 | Not Applicable (< AED 50) | AED 25.00 |

| Amendment – General | Amendments with no addition of new business activity | AED 0.00 | Not Applicable | AED 0.00 |

| Amendment – Activity Addition | Adding a new business type to existing code | AED 100.00 | AED 20.00 | AED 120.00 |

Calculate your business setup cost.

Notes:

- Knowledge & Innovation Fees are applicable only when the service fee is AED 50 or more.

- The Customs Code is valid for 12 months and must be renewed annually.

- All payments can be made through the Dubai Trade Portal during registration or update.

- Ensure your trade license is active and updated to avoid registration issues.

How to Renew Your Import and Export Custom Code in Dubai

To maintain compliance and avoid disruption in trade activities, it is essential to renew your Dubai Customs Code annually. The process is simple and fully online. But before you begin the Import and Export Custom Clearance Code renewal, make sure your contact details are updated and verified via the e-Service tool called “Manage Contact Details.”

Here’s a step-by-step guide to renewing your Import and Export Custom Code in UAE through the Dubai Trade Portal:

- Visit the official portal: www.dubaitrade.ae

- Go to the Service Centre, then click on:

Dubai Customs > Registration Tools > Renew Business Code - Enter your Dubai Customs Code and the system-generated captcha, then click OK.

- Update the expiry date to match your Import and Export business license in Dubai, and set the renewal date to the current day.

- Upload clear copies of your valid trade license and passport.

- Enter the captcha again, then click Submit to send your renewal request for approval.

The cost of Import and Export Custom Code in UAE for renewal is just AED 25. Since this amount is under AED 50, no additional Knowledge and Innovation fees apply.

Staying proactive with your renewal ensures uninterrupted use of your UAE CUSTOM / IMPORT-EXPORT CODE (IEC) and keeps your trade operations legally compliant in Dubai.

Mainland vs Freezone Company Setup in UAE: Cost Comparison

Prohibited Items in Dubai: Regulations and Approval Requirements

When importing or exporting goods through the UAE, it’s crucial for businesses to understand the regulations surrounding restricted and prohibited items. Before using your Import and Export Custom Code in UAE, you must ensure the nature of your goods complies with Dubai Customs guidelines to avoid penalties, shipment delays, or code suspension.

The Dubai Customs Code—obtained during the UAE CUSTOM / IMPORT-EXPORT CODE (IEC) new registration—gives your business legal access to trade, but it also comes with a responsibility to follow import/export restrictions carefully.

Certain items are strictly prohibited from being imported or exported under any circumstances, such as:

- Narcotics and illegal drugs

- Counterfeit currency

- Gambling tools and machines

- Items that violate Islamic morals and values

- Materials considered a threat to national security

Other items are classified as restricted, meaning they require special approvals from relevant UAE authorities before clearing through customs using your Dubai Customs Code. These include:

- Medical products (approval from Ministry of Health)

- Alcohol (approval from Dubai Police)

- Food products (approval from Dubai Municipality)

- Telecommunication equipment (approval from TRA)

- Live animals and plants (approval from MOCCAE)

Before proceeding with the Import and Export Custom Clearance Code, businesses must verify whether their goods fall under the restricted category and secure the necessary permits. This ensures smooth processing during customs clearance and avoids delays in shipment.

For businesses applying for an Import and Export business license in Dubai, it’s highly recommended to consult the best business setup consultant in Dubai to understand what is allowed under your license category and avoid complications when using your Dubai Customs Code.

Staying informed and compliant is key to efficient and legal trade operations in the UAE.

Conclusion: Your Gateway to Global Trade Starts with a Dubai Customs Code

Setting up an import-export business in Dubai opens the door to one of the most dynamic trading hubs in the world. However, to operate legally and efficiently, businesses must first obtain an Import and Export Custom Code in UAE. This code is issued by Dubai Customs and is a mandatory requirement for companies involved in cross-border trade.

By obtaining your Customs Code in Dubai UAE, you gain the legal authorization to import and export goods, streamline customs clearance procedures, and build credibility with logistics and port authorities. Whether you’re dealing in electronics, food products, industrial materials, or textiles, this code is essential to move your goods through UAE ports and free zones without delays or legal issues.

The process to get your Dubai Customs Code is straightforward but must be completed with precision—starting with a valid Import and Export business license in Dubai, followed by registration on the Dubai Trade Portal, document submission, and fee payment. Businesses must also stay compliant with customs regulations and avoid prohibited goods to maintain the validity of their Import and Export Custom Clearance Code.

Understanding the cost of Import and Export Custom Code in UAE also helps you plan better—AED 100 for new registration and AED 25 for annual renewal. Remember, restricted goods require special approvals, and failing to obtain them can affect your business operations.

If you’re planning to get a UAE CUSTOM / IMPORT-EXPORT CODE (IEC) new registration, working with a professional consultant can make the process seamless and efficient.

Read Post: Starting Food Delivery Business in Dubai

How Infibiz Can Help You Get Your Customs Code in Dubai

At Infibiz, we specialize in helping businesses navigate the entire process of obtaining their Dubai Customs Code and setting up successful trading operations in the UAE. From securing your Import and Export business license in Dubai to guiding you through the Steps to Obtain a Customs Code in Dubai UAE, our expert team ensures full compliance and fast approvals.

We take care of document preparation, portal registration, fee payments, and follow-ups—so you don’t have to worry about errors or delays. Whether you’re a startup or an established business expanding globally, Infibiz offers tailored solutions and transparent pricing to help you stay focused on growth.

Choose Infibiz, the best business setup consultant in Dubai, and start trading with confidence. Reach out today and let us help you unlock international markets with your Import and Export Custom Clearance Code.